The prospects of selling Covered Calls are attractive to investors as the strategy can be used to generate extra income in the form of option premiums when an option is out-of-the-money at expiration. However, it is important to note that this strategy does not provide much downside protection. In a case of a precipitous drop in the stock price, the call premiums can only mitigate the loss to a small extent. If an investor intends to hold the stocks, what he/she can do is to keep selling calls above the original breakeven point in an attempt to generate more premiums while hoping for the stock to recover. In the case of a prolonged drawdown, the short calls of the same strike price will become further and further out-of-the-money, causing the premium to move towards zero.

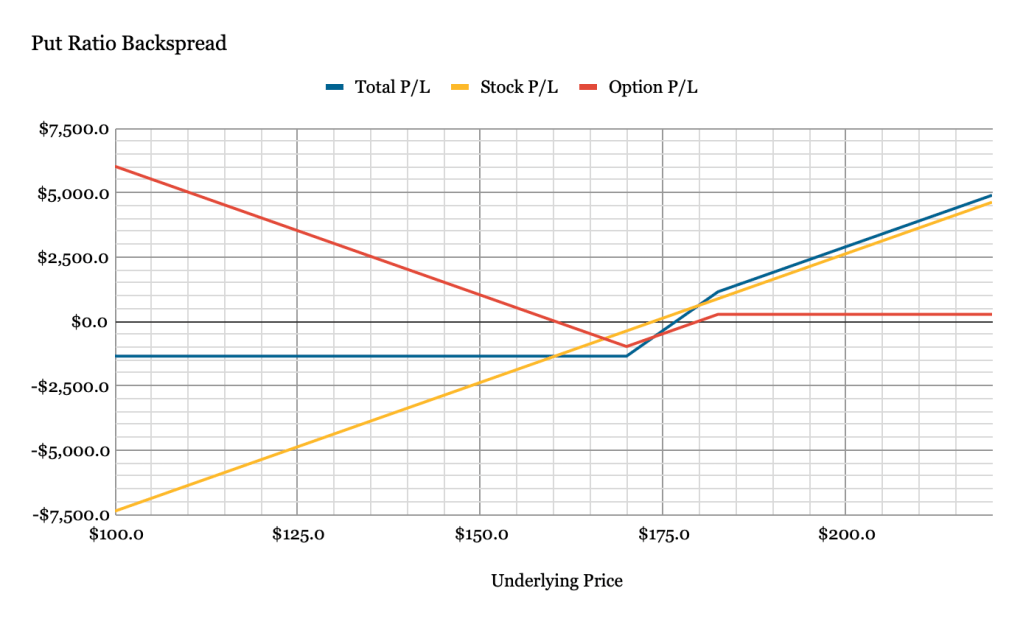

Therefore, it would be helpful to search for alternative strategies that 1) offer better downside protection, and 2) can generate extra income along the way. One strategy that has both of these qualities is the Put Ratio Backspread. The strategy involves the sale of an in-the-money put (higher strike) and the purchase of two out-of-the-money puts (lower strike) for every 100 shares of the underlying. The expense of buying the puts will be more than covered by the short puts, making this a net credit position. Unlike Covered Calls, the Put Ratio Backspread protects the downside with the long puts while not limiting the upside.

As in every option strategy, there will be a tradeoff between benefit and risk. If the stock price is in between the strikes of the short and the long legs, a loss will likely be incurred. If the stock drops lower than the strike of the long puts, the overall option p/l will start to become positive, capping the loss incurred by the stocks. The best scenario, however, is that the stock performs well and is above the strikes of both legs, causing both options to expire. When constructing the trade, it is important to select the strike price carefully, as it dramatically changes your payoff under different scenarios.

To compare the Covered Call and the Put Ratio Backspread, let’s take a look at how the payoff of the two trades on the same stock differ. The Walt Disney Company was trading at $173.73 at the time of writing. Let us assume that the Covered Call is opened simultaneously with the the purchase of 100 shares at that price. With the assumption that the stock price will not move more than 5% in either direction by expiration, the strikes that are 5% out-of-the-money are chosen for the short legs of both strategies. The strike of the long put, however, is closer to the stock price at the time in order to reduce the maximum loss. Here are the details:

| Strategy | Covered Call | Put Ratio Backspread |

| Leg A | Short 22 Jan 21 $182.5 Call x1 @ $2.5 | Short 22 Jan 21 $182.5 Put x1 @ $11.0 |

| Leg B | N/A | Long 22 Jan 21 $170 Put x2 @ $8.3 ($4.15 ea.) |

| Net Credit/Debit | $250 (or $2.5 per share) | $270 (or $2.7 per share) |

| Max Profit | $250 | $16,020 |

| Max Loss | $0 | -$980 |

| Risk/Reward | N/A | 16.35 |

| Best outcome | The stock price moving sideways/consolidating. The call expires worthless. | The stock price moves up/rallies. The spread expires worthless. |

| Worst outcome | A sharp fall in the stock price. | The stock price moving sideways/pulls back slightly. The spread gets assigned. |

| When to use the strategy | Long-term bullish. Short-term neutral. | Long-term bullish. Short-term bullish/bearish. |

With the information shown above, it should be apparent that the Put Ratio Backspread is a sound strategy in a bull market because the investor can ride the uptrend without any risk of the stocks being called away and collecting premiums from the credit spreads along the way. In a bullish to neutral market, the Put Ratio Backspread is at risk of incurring a loss if the stock consolidates and settles in between the strike prices of the spread and therefore the Covered Call might perform better under this situation. In a bear market, the Put Ratio Backspread provides much better protection than the Covered Call and is a great strategy to use if the investor does not want to let go of his/her stocks anytime soon.

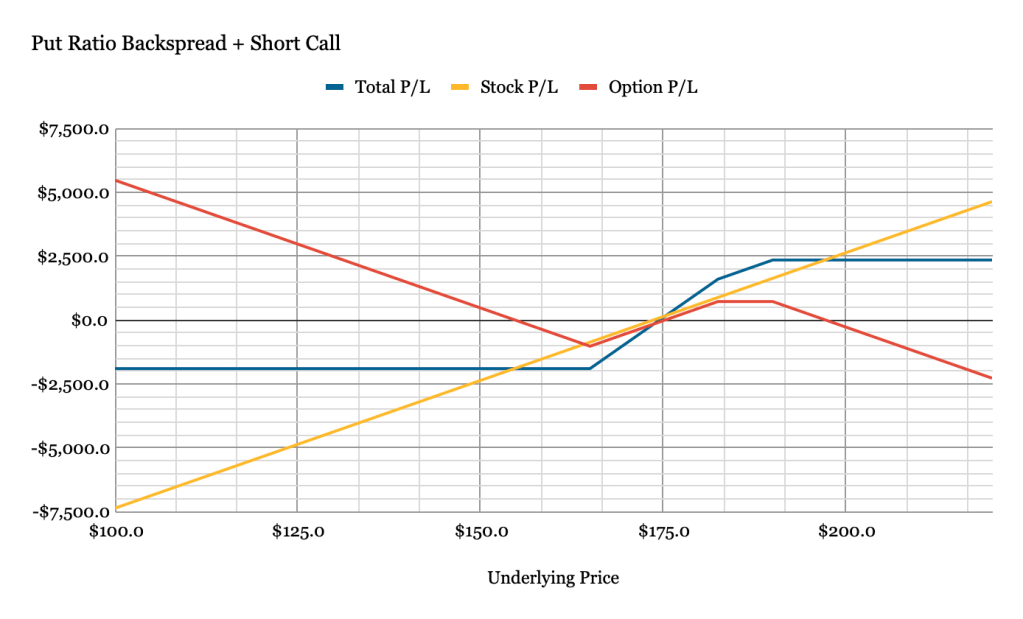

To take the Put Ratio Backspread one step further, consider selling an out-of-the-money call to earn even more premium. Think of it as a combination of the the Backspread and the Cover Call. The maximum profit is achieved when the stock price is between the strikes of the short put and the short call causing all legs to expire worthless. This strategy can be done repeatedly as long as the uptrend continues.

Like all option strategies, there will be times when adjustments need to be made. For a Covered Call that is in-the-money, either roll up the call (at a debit) to avoid assignment, or let the stocks be called away and taking profit. For a Put Ratio Backspread that becomes in-the-money, the investor can close the spread at a loss, roll down the spread further, or wait for a bearish catalyst to pan out, causing a sharp drop in the stock price. Either way, if the spread gets assigned, the loss can be mitigated by the credit earned by selling the out-of-the-money call to some degree.

Hopefully I have painted a clear enough picture of the benefits and risks of the Put Ratio Backspread. I have personally opened a couple of such positions against my stocks. If there is more insight I can provide, I will definitely keep everyone posted.

J

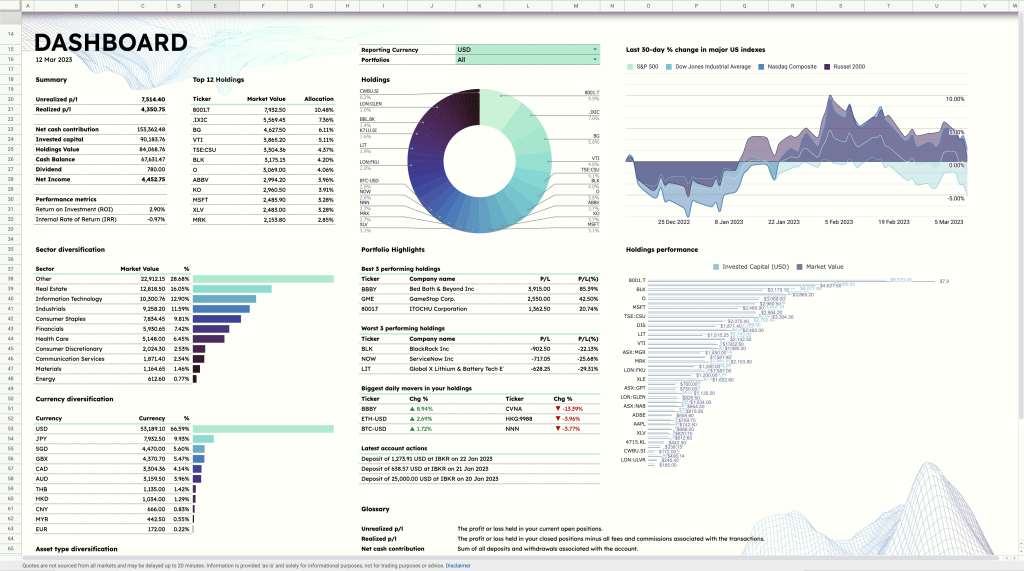

I hope you enjoy this tutorial as much as I enjoy writing it. If you’re into organizing your life, be sure to check out the ZestFi Stock Portfolio Tracker. Not your typical Google Sheet template, the ZestFi Stock Portfolio Tracker lets you easily track all your stocks even if you have multiple accounts, own different types of assets, and hold multiple currencies! This tracker makes use of the GOOGLEFINANCE API to fetch stock price updates and provides powerful analytics presented in a ultra clean dashboard, helping you make the best investment decisions. Say goodbye to the hassle of going back and forth between different apps and website to manage your investments, and say hello to ZestFi!