Hey there, fellow investors! It’s time to dive into a classic debate in the world of finance: Should you use ROI (Return on Investment) or IRR (Internal Rate of Return) to evaluate your investment portfolio performance? Buckle up as we explore this topic and help you make an informed choice.

Understanding the Basics: ROI vs. IRR

First things first, let’s break down the fundamentals:

ROI (Return on Investment)

ROI measures the percentage change in the value of your investment over a specific period. It’s a widely used metric in finance and stands for Return on Investment. The formula is quite simple:

ROI = (Ending Value - Beginning Value) / Beginning ValueHere’s what it means:

- Beginning Value: The initial investment.

- Ending Value: The value of your investment at the end of the period.

Let’s apply this formula in an example! Suppose you invested $1,000 in a stock, and after one year, it’s worth $1,150. Your ROI would be:

ROI = (1150 – 1000) / 1000 = 0.15 or 15%

Not bad!

IRR (Internal Rate of Return)

IRR (Internal Rate of Return) goes a step further. It’s like a supercharged version of ROI that takes into account the timing and size of cash flows. IRR helps you find out the annualized rate of return that makes the Net Present Value (NPV) of all your cash flows equal to zero. The formula for IRR is:

0 = NPV = Σ [(Cash Flow at Time t) / (1 + IRR)^t] - Initial InvestmentHere’s the breakdown:

- NPV: The total value of all your cash flows.

- Cash Flow at Time t: The money you get at a specific time.

- Initial Investment: The money you put in at the start.

- IRR: The magical rate you’re trying to find.

If you find this daunting, worry not. Let me show you an example so you can understand it better.

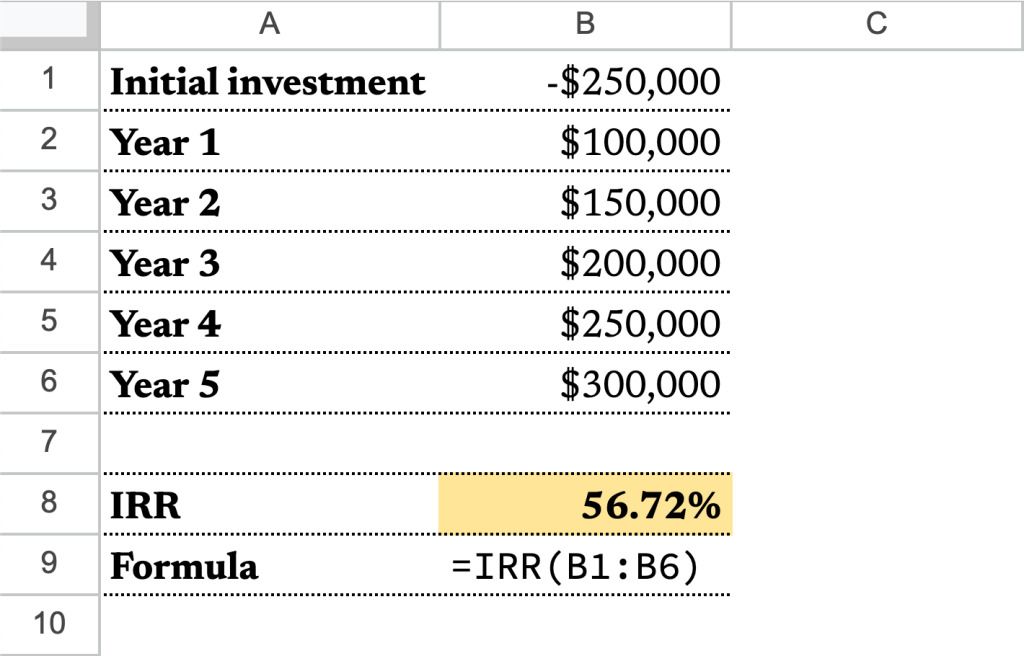

Let’s say you invested $250,000 in Project X, which has these cash flows:

- Year 1: $100,000

- Year 2: $150,000

- Year 3: $200,000

- Year 4: $250,000

- Year 5: $300,000

Using Google Sheets, you find that the IRR for Project X is 56.72%. This means your investment is expected to grow by about 56.72% every year. Not bad, right?

When to Use ROI

ROI has its merits, especially for straightforward investment scenarios:

- Quick and Easy: Calculating ROI is a breeze. It’s perfect for those who want a rough estimate of how their investments are doing without delving into complex financial calculations.

- Periodic Returns: If you want to gauge your returns over specific time intervals, ROI shines. It’s fantastic for measuring short-term gains or losses.

- Same-Sized Cash Flows: When your investments involve regular, equal-sized cash flows (like monthly contributions to a retirement fund), ROI can provide a clear picture of your progress.

When to Use IRR

Now, let’s give IRR its moment in the spotlight:

- Irregular Cash Flows: If your investments involve sporadic contributions or withdrawals, IRR is your knight in shining armor. It accounts for the timing and magnitude of these cash flows, giving you a more accurate return figure.

- Complex Investments: For complex portfolios with multiple assets and cash flows, IRR provides a more accurate assessment of performance. It considers the intricacies of your investments, making it the go-to choice for savvy investors.

- Comparing Investments: When evaluating multiple investments with different cash flow patterns, IRR helps you make apples-to-apples comparisons. It considers the opportunity cost of your capital.

The Verdict: A Balancing Act

So, should you use ROI or IRR? The answer is both, depending on your investment goals and portfolio complexity.

Until next time,