Alpha is a crucial metric in the world of finance that measures excess returns and provides insights into how well a manager or investment has performed compared to a benchmark. It is a key indicator of whether a manager is outperforming or underperforming passive investment strategies with similar market exposures.

Alpha, represented as α, provides insights into whether a manager is exceeding or falling short of expectations in relation to a benchmark index. To grasp this better, consider the following scenario:

Suppose a manager has a beta (β) of 20% to the S&P 500, and the S&P 500 delivers a 10% return for the year. In this case, we would anticipate the manager to generate a return of 2%.

2%=10%×20%2%=10%×20%

However, if the manager actually achieves a return of 9%, the excess return, known as α, amounts to 7%.

7%=9%−2%7%=9%−2%

This 7% represents the manager’s alpha for the year.

The Regression Equation

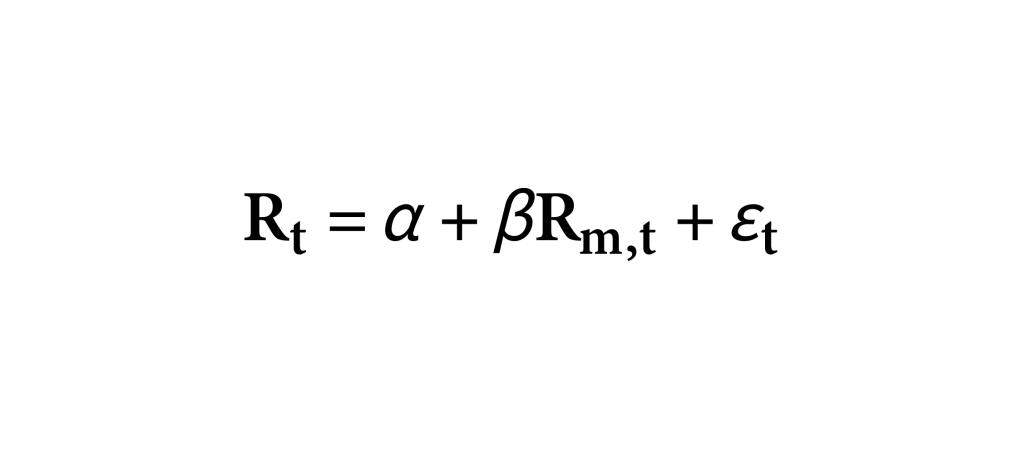

Formally, we can determine alpha through a regression analysis of the manager’s returns against a benchmark index. Let’s represent the manager’s return at time t as Rt, and the market return at the same time t as Rm,t. The regression equation looks like this:

Here, α and β are constants, and ϵ represents a mean-zero error term. The usage of α and β in finance traces back to the statistical constants used in regression equations. Alpha, in this context, signifies outperformance, while beta measures market exposure.

The Role of Jensen’s Alpha

Jensen’s alpha, sometimes used interchangeably with alpha, accounts for the risk-free rate by subtracting it from both Rt and Rm,t before performing the regression analysis. This adjustment ensures that alpha reflects the true excess return generated above the risk-free rate. It aligns with the Capital Asset Pricing Model (CAPM), a cornerstone in finance theory.

Daily Beta for Active Managers

While the previously mentioned regression equation can be computed using realized returns, it assumes that beta remains constant. For active managers whose market exposures fluctuate, a more precise approach involves calculating the portfolio’s beta daily and determining alpha based on daily realized returns, repeating this process daily. This method, although computationally intensive, yields more consistent results when assessing active manager performance.

In summary, alpha encapsulates the excess return a manager achieves compared to a benchmark index. It’s a valuable metric in evaluating investment performance, shedding light on an active manager’s ability to generate returns above expectations. Understanding this concept is essential for investors seeking to make informed financial decisions.