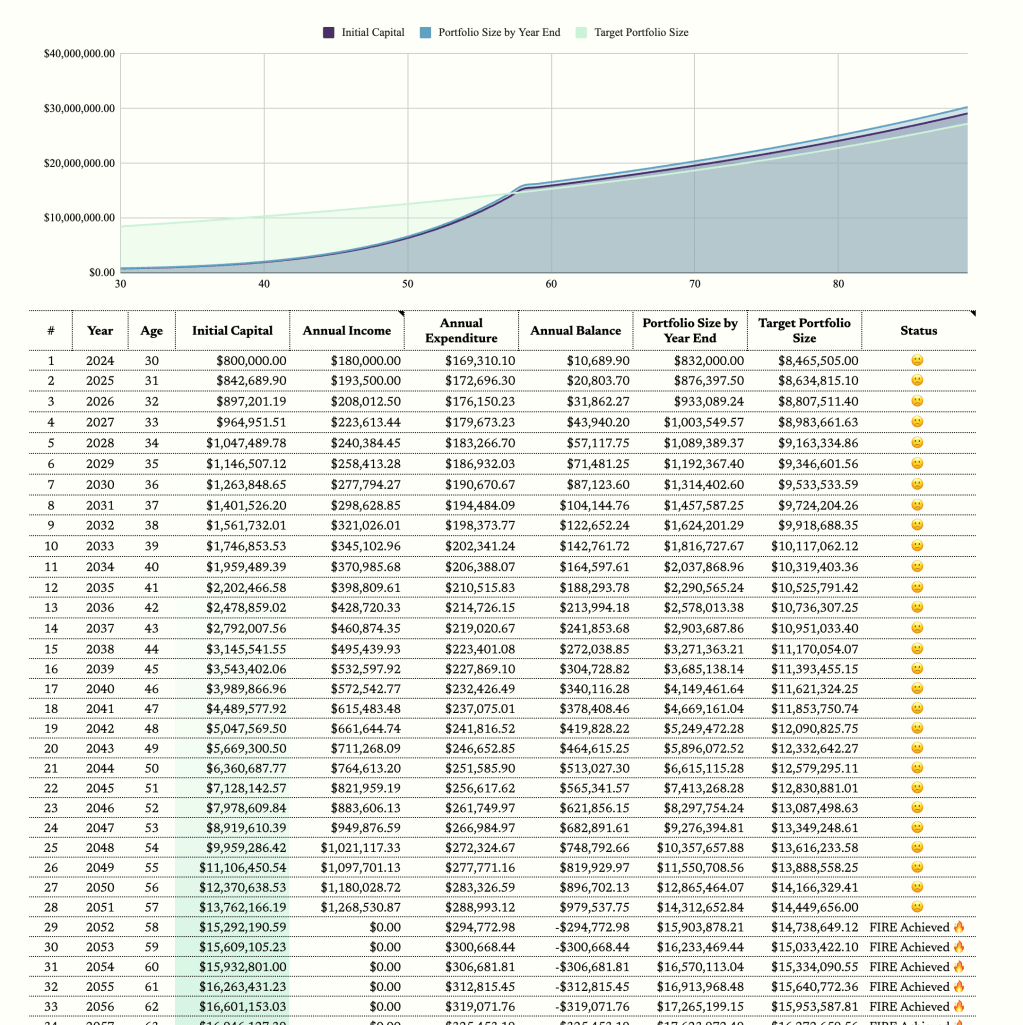

The pursuit of financial independence and early retirement (FIRE) has gained immense popularity, especially among millennials, driven by the desire to gain control over their financial future and retire well before the conventional retirement age. A key principle in this movement is the 4% rule, a guideline derived from the influential Trinity Study, which offers a method to determine safe withdrawal rates from retirement portfolios. This blog post will delve into the 4% rule, explain the assumptions behind our spreadsheet template, and guide you through its inputs and functionality.

To assist you in your financial planning, we offer a FREE spreadsheet template titled “Investment Analysis Toolkit by zestfi.io.” This toolkit includes a detailed sheet that demonstrates the calculation of the inflation-adjusted 4% rule, providing a more realistic picture for those planning to achieve FIRE.

What is the 4% Rule?

The 4% rule originates from the Trinity Study, a seminal piece of research conducted by finance professors at Trinity University in 1998. This study sought to determine safe withdrawal rates from retirement portfolios containing a mix of stocks and bonds. The rule suggests that you can withdraw 4% of your portfolio’s initial value in the first year of retirement and then adjust this amount for inflation each subsequent year. This approach aims to ensure that your portfolio lasts at least 30 years, thereby providing a steady income stream throughout retirement.

Assumptions of the Spreadsheet Template

Our spreadsheet template is designed to help you apply the 4% rule while accounting for inflation and other financial variables. Here are the key assumptions behind the template:

- Pay Keeps Pace with Inflation: Your income will rise in line with inflation, maintaining your purchasing power.

- Stable Annual Income and Expenditure: It is assumed that your income and spending habits will remain relatively consistent over the years.

- Consistent Investment Returns: The template assumes steady returns on your investment portfolio, which is crucial for long-term financial planning.

Inputs in the Google Sheet

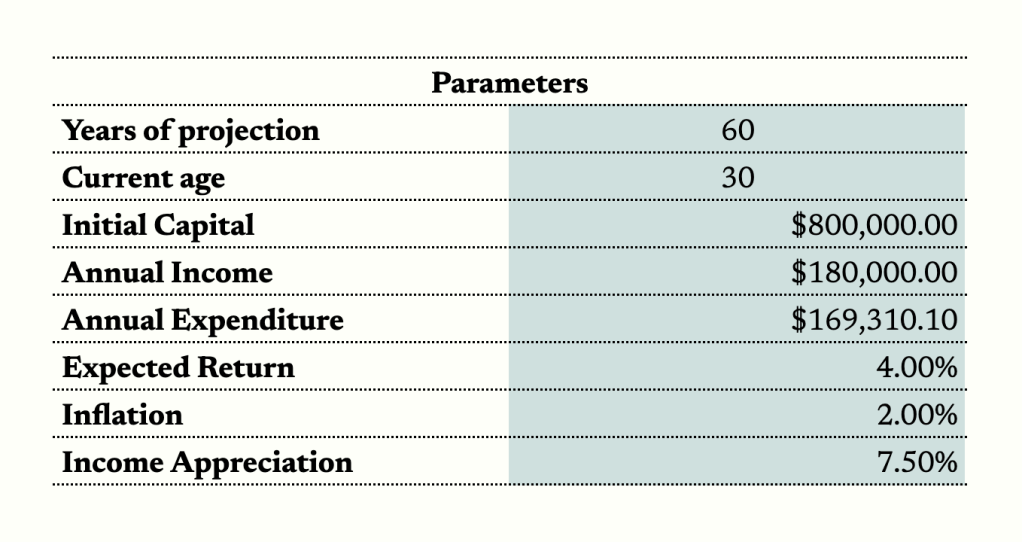

You’ll need to input several parameters for the growth projection of the portfolio to be calculated. Here’s a breakdown of each input:

Years of Projection

Specify the number of years into the future you want to project your financial scenario

Current Age

Enter your current age to tailor the projections to your specific timeline

Initial Capital

Specify the amount of liquid cash you currently have available for investment

Annual Income

Input your current annual income. This figure will be adjusted for inflation over the projection period.

Annual Expenditure

Estimate your current annual expenditure. It’s assumed that this amount will remain relatively constant over the years, adjusted only for inflation.

Expected Return

Set the expected annual return rate for your investment portfolio

Inflation Rate

Input the expected inflation rate. This rate will adjust your income and expenditures annually.

Income Appreciation

Specify the rate at which you expect your income to grow annually. This appreciation helps in adjusting your income projections to reflect potential salary increases or other income growth factors.

Caveats

It’s important to note that many factors in this calculation are volatile and can significantly impact your financial projections. Inflation rates, investment returns, and income growth can all fluctuate, making it essential to periodically review and adjust your assumptions and inputs. The provided projections should not be solely relied upon for making investment decisions.

Please remember that this tool is for informational purposes only and does not constitute financial advice. It’s crucial to conduct your own due diligence and consult with a financial advisor before making any investment decisions.

For a practical demonstration and to start planning your financial future with more accuracy, download the FREE “Investment Analysis Toolkit by zestfi.io” which includes a detailed sheet to calculate the inflation-adjusted 4% rule. This tool will help you get a clearer picture of your path to financial independence and early retirement.

Need help? Reach me @

- Official site: zestfi.io

- Gumroad: zestfi.gumroad.com

- Twitter/X: x.com/joshuaZestFi

- Email: admin@zestfi.io