-

In the realm of statistics and finance, one term that often makes its way into discussions about risk and probability is “kurtosis.” But what exactly is kurtosis, and why does it matter in the world of investments? Let’s delve into the intricacies of kurtosis, exploring its mathematical underpinnings, its implications for probability distributions, and its…

-

An activist hedge fund is a type of investment fund that employs an activist investment strategy. Unlike traditional hedge funds that focus solely on maximizing returns, activist hedge funds take a more hands-on approach by actively engaging with the management of the companies in which they invest. The primary goal of an activist hedge fund…

-

Welcome to the world of Sharpe ratios—a powerful tool in portfolio management that helps investors assess the return of an investment relative to its risk. In this tutorial, we’ll leverage the magic of Google Sheets to calculate Sharpe ratios and compare the performance of Apple stock (AAPL) against the S&P500 over the last three years.…

-

The Sortino ratio is a risk-adjusted performance measure that calculates the return per unit of downside risk. It is similar to the Sharpe ratio, but it uses the standard deviation of negative returns instead of the total standard deviation. The Sortino ratio is calculated as follows: The risk-free rate is the return of an investment…

-

The Sharpe ratio is a measure of the risk-adjusted return of an investment. It is calculated by dividing the excess return of an investment over a risk-free asset by the standard deviation of the investment’s returns. The excess return is the return of the investment minus the return of the risk-free asset. The standard deviation…

-

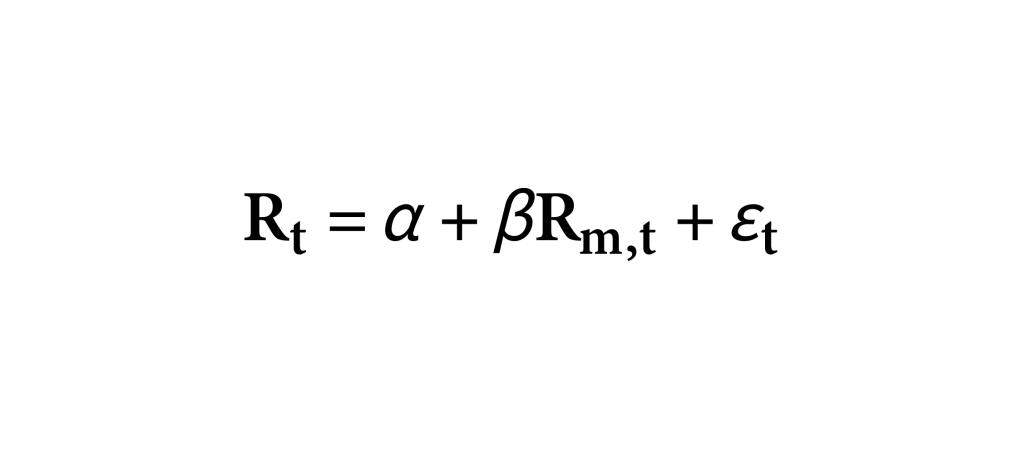

In our previous blog post, we delved into the world of alpha and its significance in investment analysis. Today, we’re taking it further: by exploring how to calculate two key performance metrics, alpha (α) and beta (β), for your investment portfolio right within Google Sheets™. But first, let’s quickly recap what alpha and beta represent.…

-

Alpha is a crucial metric in the world of finance that measures excess returns and provides insights into how well a manager or investment has performed compared to a benchmark. It is a key indicator of whether a manager is outperforming or underperforming passive investment strategies with similar market exposures. Alpha, represented as α, provides…

-

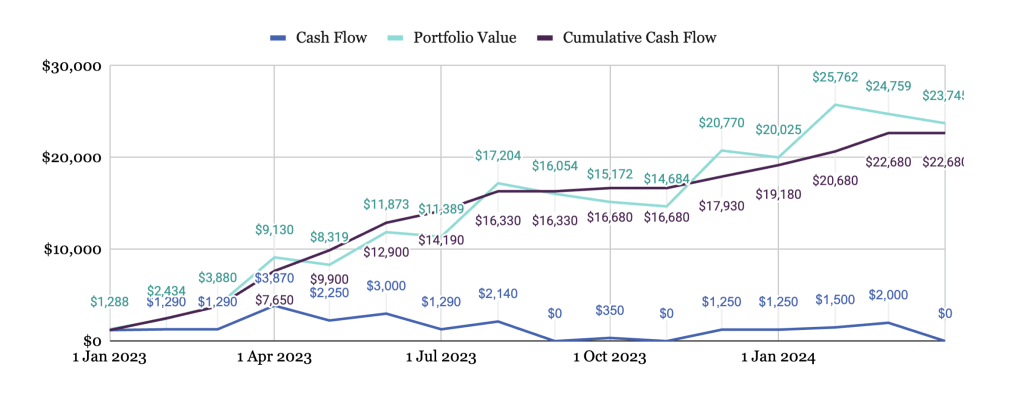

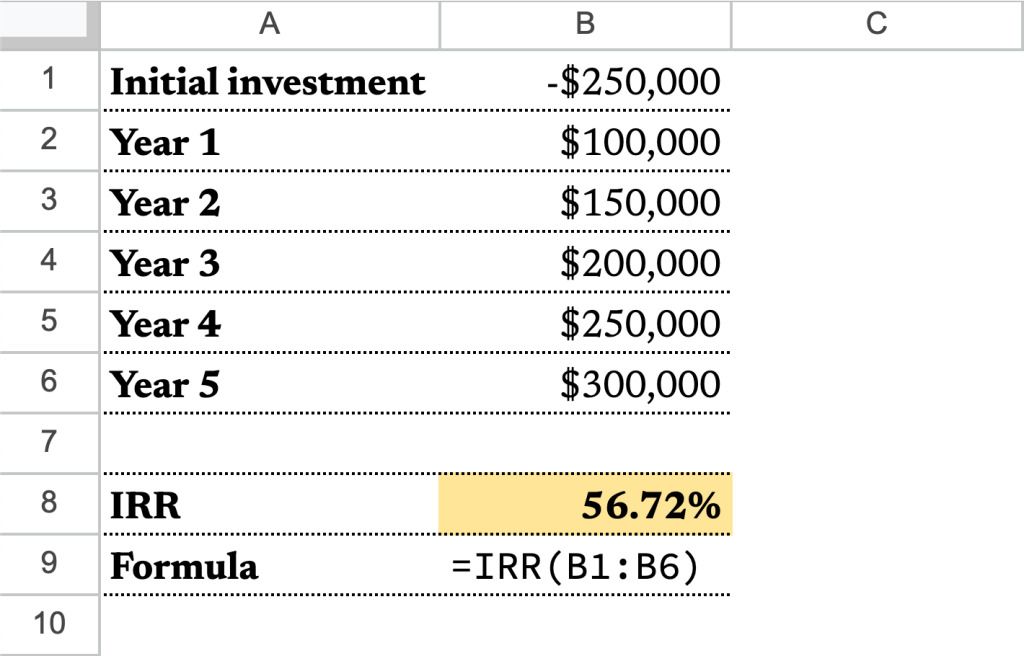

When it comes to evaluating the performance of your investments, two critical metrics that can help you make informed decisions are Internal Rate of Return (IRR) and Extended Internal Rate of Return (XIRR). These metrics provide insights into the profitability and efficiency of your investments over time, considering cash flows at different periods. In this…

-

Hey there, fellow investors! It’s time to dive into a classic debate in the world of finance: Should you use ROI (Return on Investment) or IRR (Internal Rate of Return) to evaluate your investment portfolio performance? Buckle up as we explore this topic and help you make an informed choice. Understanding the Basics: ROI vs.…

-

Hey everyone, Spreadsheets, oh boy! These digital workhorses are more than just cells and formulas; they’re the unsung heroes of organization and analysis. Whether you’re crunching numbers, managing finances, or decoding data, you want to do it like a pro. Well, I’ve got you covered with the ZestFi style of spreadsheet mastery. Let’s dive in!…

-

Subscribe

Subscribed

Already have a WordPress.com account? Log in now.